A number of barriers to pre-exposure prophylaxis (PrEP) uptake, use, and adherence have been identified—cost shouldn’t be one of them

By James Krellenstein and Jeremiah Johnson

On July 16, 2012, the U.S. Food and Drug Administration (FDA) approved Gilead Sciences’ Truvada (co-formulated tenofovir disoproxil fumarate and emtricitabine) for HIV pre-exposure prophylaxis (PrEP). The approval of Truvada is a historic advance for HIV prevention efforts. Results of multiple randomized controlled trials indicate that PrEP is highly effective in preventing HIV infection; the risk of sexual HIV acquisition can be reduced by more than 99 percent in individuals who take the drug consistently. Despite the overwhelming success of PrEP in preventing HIV infection in trials and postapproval demonstration projects, uptake in the real world has been painfully slow. In February of this year—nearly four years after FDA approval—Gilead estimated that only 40,000 U.S. residents were on Truvada for PrEP, less than four percent of the 1.2 million for whom the Centers for Disease Control and Prevention (CDC) estimates PrEP is indicated.

One barrier to the adoption of Truvada as PrEP that has received surprisingly little attention from activists is its price. Truvada, despite costing very little to produce, is an incredibly expensive drug to purchase, with an average retail reimbursement price of over $1,700 per 30-day supply in 2015.

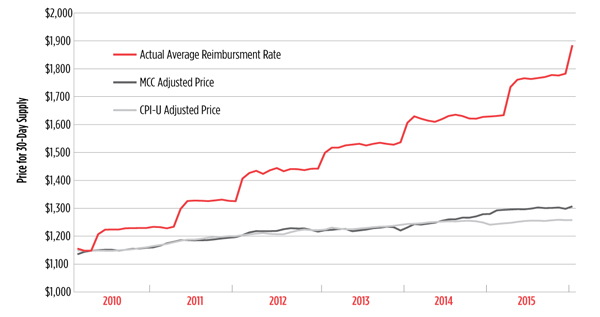

FIGURE: Actual Truvada Reimbursment Cost vs. CPI-U and MCC Adjusted Prices

The average retail reimbursement price for Truvada grew six times faster than overall inflation (consumer price index for all urban consumers [CPI-U] inflation) and four times faster than inflation for drugs and other medical commodities (medical care commodities [MCC] inflation).

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Medical Care Commodities [CUUR0000SAM1] [Internet]. Saint Louis (MO): Federal Reserve Economic Data, Federal Reserve Bank of Saint Louis (cited 2016 March 1). Available from: https://research.stlouisfed.org/fred2/series/CUUR0000SAM1.

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items [CPIAUCSL] [Internet]. Saint Louis (MO): Federal Reserve Economic Data, Federal Reserve Bank of Saint Louis (cited 2016 March 1). Available from: https://research.stlouisfed.org/fred2/series/CPIAUCSL.

Bloomberg Intelligence Biotech Drug Explorer [Bloomberg Terminal]. New York (NY): Bloomberg L.P. [cited 28 February 2016]. Available (on Bloomberg Terminal) from: BI PHRMX <GO> “Drug Explorer.”

Truvada was first approved in 2004 to treat HIV in combination with other antiretrovirals, but researchers were also interested in its potential to be used as PrEP, ultimately leading the National Institutes of Health to fund the key studies that established its value for HIV prevention. Although Gilead Sciences now profits handsomely from the use of Truvada for PrEP, it funded none of the research that led to the drug’s approval for this indication. Despite this, the company has refused to ensure affordable access to Truvada and, since 2010, has been increasing its price at a rate six times that of inflation—more than doubling the price since 2004.

The exorbitant price of drugs that treat HIV has long been a concern of AIDS activists. Indeed, the first drug approved for the treatment of HIV—zidovudine, commonly known as AZT—was, at the time of its introduction, the most expensive drug in history despite costing almost nothing to produce and being discovered through taxpayer-funded research. Ironically, just to ensure that people with AIDS were able to get AZT, Congress was forced to appropriate even more taxpayer money to create the Health Resources and Services Administration’s AZT Drug Reimbursement Program in 1987—which would lay the groundwork for the AIDS Drug Assistance Program (ADAP)—to subsidize the high price of the drug as well as give people without health insurance access to it. In 1990, as more antiretrovirals were approved, Congress incorporated ADAP into the Ryan White HIV/AIDS Program, which to this day ensures that uninsured and underinsured people living with HIV can get antiretroviral drugs.

Although the Ryan White program has been highly effective in ensuring near-universal access for HIV-positive individuals in the United States, no such programs exist for those who are HIV-negative. In lieu of this, people taking PrEP who lack health coverage are forced to rely on Gilead’s medication assistance program (MAP) to obtain this incredibly expensive therapy. In addition to being without any form of health insurance, individuals must have an income less than 500 percent of the federal poverty level ($55,990) to be eligible for the program. The MAP, however, is not broadly used because it does not cover required PrEP-related medical costs such as quarterly blood work.

People who have some form of health care coverage, however, must use their insurance to pay for Truvada and, in the case of private insurance plans, use Gilead’s co-pay assistance program (CAP) to pay for the often-exorbitant out-of-pocket expenses (e.g., deductible spend downs, copayments, and coinsurance amounts). For people with high-quality coverage, such as through “platinum” health insurance plans purchased in the health insurance marketplaces (exchanges) mandated by the Affordable Care Act (ACA), this poses almost no challenge as their out-of-pocket prescription expenses are likely below Gilead’s CAP allowance of $3,600 a year. Unfortunately, for many health care plans, the expected out-of-pocket costs for a person on Truvada would far exceed $3,600 a year. Health insurance plans are allowed by statute to charge up to $6,850 a year in out-of-pocket expenses for covered services, including pharmacy benefits.

The discrepancy between the maximum out-of-pocket expenses and Gilead’s CAP is particularly problematic for individuals who have “bronze” and “silver” plans purchased through the exchanges. More than 90 percent of health insurance plans purchased on the exchanges have been bronze and silver. On almost all health insurance plans, individuals have to pay a certain amount—known as the deductible—before receiving any benefits from the health insurance plans (and before co-payments or co-insurance requirements begin). Eighty-seven percent and 21 percent of bronze and silver plans, respectively, have combined medical-drug benefit deductibles in excess of $4,000 per year, with 38 percent of bronze plans having a deductible above $6,000.

For many individuals covered by bronze or silver plans, the out-of-pocket expenditures for a year of Truvada can exceed $3,000—even assuming a full use of the Gilead CAP––posing a significant barrier to many individuals who need PrEP. Indeed, even a much smaller out-of-pocket cost can become a deterrent. According to data reported in February at the Conference on Retroviruses and Opportunistic Infections by a Northern California Kaiser Permanente program, individuals with a co-pay of over $50 were significantly more likely to discontinue PrEP—31 percent of those with the higher co-pay dropped PrEP, compared with 21 percent for those with co-pays less than $50.

The Patient Advocate Foundation, funded in part by Gilead, does have a program to reimburse out-of-pocket costs in excess of the CAP allowances for those meeting certain criteria (income less than 400% of the federal poverty level, with adjustments for cost of living), although it appears that few people actually know about this program. Each layer of complexity that is added to covering out-of-pocket costs needlessly obstructs access to this incredibly important HIV prevention tool, particularly when support services like prevention case management are rarely available.

An obvious solution to this problem would be for Gilead to simply increase the CAP maximum to the statutory maximum of out-of-pocket expenses. A near doubling of its CAP contribution might seem like a large financial contribution, but it is important to remember that by matching the ACA maximum out-of-pocket cost, Gilead would almost certainly be increasing its sales volume. Additionally, given that Gilead’s present market cap—the total dollar market value of the company’s outstanding shares—is over $125 billion (as of early March 2016), the company is likely capable of weathering an even more substantial cut in profit.

Unfortunately, it can be challenging to determine the impact on Gilead of any such changes given the longstanding tradition of cloak-and-dagger secrecy when it comes to pharmaceutical companies’ full budgets, particularly their research and development costs. Instead, we are always led to believe that the pharmaceutical industry is toiling in climates of scarcity due to sky-high research and development costs that we are assured exist even though no one is allowed to see proof.

If increasing access for communities that have seen the AIDS epidemic rage on for over three decades really is the main priority, advocacy pushing to improve and expand both the Gilead MAP and CAP are just two objectives. Advocacy is also needed to ensure that insurers and government are doing their parts to end the ongoing HIV epidemic; that includes expanding Medicaid in all 50 states so that low-income people vulnerable to HIV infection have access not only to PrEP, but also to the care needed to support its safe and effective use.

Even if the ACA were to be fully implemented in all states, however, the high price of Truvada makes it challenging to effectively engage public and private payers regarding the need for unencumbered access to PrEP and related prevention services. Facing such enormous costs means that both private and public insurers are hard pressed and, arguably, more justified in implementing cumbersome and time-consuming prior authorization requirements, increasing cost-sharing responsibilities, mandating specialty pharmacy ordering, and enacting other deterrents that frequently discourage uptake. The high price, even after taking into account discounts and rebates that are applied to drugs being covered by federal or state spending, is also likely to serve as a deterrent to state and local governments’ exploring the development of other public programs, such as the Washington State PrEP Drug Assistance Program, to expand access. One of the best examples of how potential systemwide costs can set the stage for battles over coverage comes from the United Kingdom, where the National Health Service is likely dragging its feet on approving PrEP largely due to the potential cost.

Gilead’s reluctance to prioritize access to PrEP is ethically troubling on two fronts. First, Gilead is only grudgingly engaging in measures to improve access to a medication in which they themselves have invested little. The initial studies that ultimately led to approval of Truvada as PrEP were funded solely through taxpayer money via the U.S. National Institutes for Health. Gilead did donate free drug to these studies, but considering how cheap it is to make Truvada (in 2005, Gilead stated that the cost of manufacturing and distributing a month’s supply was less than $30), its contribution is unquestionably negligible compared with what the American public invested. This fact has not deterred Gilead from maintaining the already exorbitant price of Truvada and even disproportionately increasing its cost relative to the rate of inflation.

Second, Gilead is profiting from its PrEP monopoly while strategically allowing HIV infections to continue. Gilead currently possesses five of the six top HHS recommendations for HIV treatment, meaning that its best business model for maximizing profit most likely does not involve a full scale-up of PrEP and a good faith effort to end the epidemic. Gilead would profit most by providing PrEP to populations at lower risk of getting HIV to avoid cutting too far into its HIV treatment market. Given that communities with lower incomes tend to disproportionately bear the burden of HIV, the fact that PrEP continues to be far more accessible to individuals with greater resources could be seen as good news for Gilead’s shareholders.

It may seem cynical and unfair to accuse Gilead of perpetuating an epidemic for financial gain, but this is not the first time that Gilead has privileged profit far above access, equity, and public health (see “Greed and the Necessity for Regulation”).

While Gilead has participated in state- and city-level efforts to increase access to PrEP, including the opening of a PrEP clinic in Atlanta and guaranteeing additional discounts for Medicaid as part of the New York State plan to end the AIDS epidemic, these efforts are merely a drop in the bucket compared with what will be required to provide access to comprehensive HIV prevention for all key populations. At a minimum, Gilead must increase its CAP contribution to match the current maximum out-of-pocket cost for ACA coverage plans, which for 2016 is $6,850 per year for individual plans (and $13,700 for a family plan—an important consideration for young people, who are especially vulnerable to HIV infection, still on their parents’ policies). Gilead must also widely and aggressively promote its MAP and CAP and reduce paperwork burdens for individuals to apply. If Gilead were truly invested in ending the epidemic, it would lower the price to a level that wouldn’t burden overstretched public programs; minimize the need for prior authorization and prohibitive cost-sharing requirements; and otherwise demonstrate a commitment to an evidence-based public health strategy through tremendous public investments.

Without a doubt, it is in everyone’s interests for the pharmaceutical industry to continue making profits; we must always weigh activist demands for price reductions with the true costs of developing innovative treatments and the costs of providing access to nations in the developing world. However, when the pursuit of profit so clearly detracts from access and ensures huge disparities in care between the rich and poor in America, particularly when Gilead refuses to disclose research and development budgets to justify such high profits from PrEP and its HIV and hepatitis C medications, it is time for activists to apply whatever pressure is necessary to create meaningful change.